100 + TOTAL TRANSACTIONS COMPLETED!

Download Brochure

Download Brochure

– Bought, Sold, and Owned over 16+ Million in Real Estate in since 2003.

– RENOVATIONS: 28 Bought and Sold

– WHOLESALES: 9 Bought and Sold

– BROKERAGE: 9 Retail Transactions

– SHORT SALES: 3 Fully Negotiated

– CASHFLOWING RENTALS: 34 Purchased

– Motels: 3

– Mobile Home Parks: 8

Our overall investment strategy and specialty is to purchase distressed properties at a deep discount – usually 30% to 50% below market value, and renovate and sell those properties to retail homebuyers and landlords.

At Success Story, we pride ourselves on having a strong foundation of real estate knowledge and training. Our focus is on providing SOLUTIONS for our clients and finding VALUE for our investors by locating ugly, vacant homes that are eye sores and we put them back into use after renovation.

Our core business lies within our systems, education and knowledge of the real estate industry. We did not just buy a CD off the Internet and become a real estate investor overnight. We have spent thousands of dollars to learn how to be successful in this business and do it the right way the first time. Through our affiliation, we are connected with a national network of investors that provide continual support and weekly trainings on changes throughout our industry. This process has allowed us to circumvent many pitfalls most novice investors would make. Learning the hard way is not a phrase in our vocabulary, and we certainly would not ask anyone to invest with us if we weren’t confident enough to invest ourselves!

We Follow A Strict Due Diligence Process

We have a systematic and disciplined approach when purchasing investment properties, putting each potential investment through a strict due diligence process. This rigorous set of criteria includes, but is not limited to, the following:

Our company can acquire great deals on properties because we have the ability to act quickly and can close with CASH on the seller’s timeline. This is why we can buy properties at such a discount. Obtaining loans through private money lenders gives us this competitive advantage over other investors who sometimes take weeks to go through the time consuming bank approval process in order to purchase properties. We have an aggressive TEAM approach, and a top-notch ability to expand our client base through our knowledge of deal structuring and advanced real estate techniques.

We also employ marketing strategies as soon as we purchase a home– giving us a fair advantage over a Realtor. Typically, most realtors don’t spend time or money on marketing or lead generation strategies. As a result, it can sometimes take months to attract potential buyers. Often times, we are able to find our own buyers allowing us to secure a strong sales price and save on sales commissions. Our renovation process is also down to a science with handpicked and proven construction crews who know we are not retail clients. We pay wholesale prices to all contractors and typically get bulk discounts on all materials.

Advantages to Working With Us

Investing with us also provides a win-win for the homeowner as well. With your cash funding, we can offer homeowners something that very few buyers can. We are helping sellers by purchasing their homes in their timeline - in as little as 10-14 days. Knowing that we’re going to renovate the home and we are buying in as-is condition is a very important factor to sellers who live in older, outdated homes, or those needing repairs. These sellers will also not be required to pay any attorney fees, closing costs, home warranties, inspection fees, realtor commissions, etc. We are not the perfect fit for everyone; but for the seller with the right motivation, these features are a necessity.

Here are just a few benefits sellers have of working with Success Story to sell a home:

Most homeowners have no idea what options are available to them beyond listing a house with a Realtor or trying to sell the house on their own and just hoping for the best. We provide a unique alternative to listing their house on their own or with a Realtor.

When we work directly with a home seller, what we provide can not only make for a smooth transaction, but it can also add up to thousands upon thousands of dollars in savings as compared to selling a home through traditional means. Our “out of the box” creative approach to real estate investing is a cut above the rest.

How Do We Compare to a Traditional Buyer?

| Traditional Buyer | SUCCESS STORY | |

|---|---|---|

| Method of Payment | Bank Financing | CASH |

| Repairs | 1-8% of Homes Value | None (Sold AS-IS) |

| Closing Timeframe | 45+ Days | 10-14 Days |

| Commissions | 6% of Sale Price | None |

| Seller Paid Closing Costs | 1-6% of the Purchase Price | Zero |

| Appraisal | Mandatory | None |

| Length of Time on Market | 150 Days on the Market (On Average) | 0 Days |

Our goal is to buy distressed homes in stable areas where there is still strong buying demand. Part of our grand vision is to improve the overall quality of living in both urban and suburban neighborhoods. In addition to improving overall quality of life, we are committed to increasing the value of real estate in our community. Our company builds value by rehabilitating properties that are in significant need of repairs. We are able to target distressed properties and breathe new life back into them by renovating and improving the condition of the property. By doing so, we are able to create beautiful homes and encourage home ownership.

Types of Properties We Target

The ability to identify a wise real estate investment is certainly a learned skill. We have been thoroughly trained and possess this skill - along with the intuition to spot these great investment opportunities in today’s market.

Not every opportunity is a “good deal”, and we have built our company on a stable foundation knowing our numbers. If the numbers don’t make sense to us it certainly won’t make sense to our investors. Our goal is to be in business for many years and brand a company that will be passed down to our children, which cannot be accomplished by taking uncalculated risks.

At Success Story, we have created a marketing machine that produces a consistent flow of high quality leads. We are very different from our competitors because we don’t just put in offers on MLS properties - we take it to the next level. Our creative marketing strategies allow us to reach the homeowner directly, before the property even goes to a Realtor to be listed on the MLS; whereas, the purchase price would escalate.

| Internet | Traditional Buyer | SUCCESS STORY |

|---|---|---|

| Probate | Bandit Signs | |

| Buyer Squeeze Pages | Pre-Foreclosure | Networking Events |

| Seller Squeeze Pages | Back Tax | Door Hangers |

| Primary Websites | Free n Clear | Other Wholesalers |

| Facebook Business | Code Violations | House Banners |

| Google Business Listings | Divorce | Bird Dogs |

| Google Ad Words | Expired Listings | A-Team Van |

| You Tube | Non Owner Occupied | Zbuyer |

There are many methods we use to sell properties very quickly. We invest a lot of time and money into marketing to build a strong list of buyer clients for our homes. Despite what the media says, there are tons of buyers out there who are aware of the fact that numerous buying opportunities exist in today’s real estate market. The problem is: they just don’t know how to identify and analyze them to ensure they are actually getting a good value. That’s where we come in. We are constantly on the hunt for the next great buying opportunity, and use proven techniques to analyze investment properties.

Methods We Use to Sell Properties

Our ability to locate a great real estate deal covers all types of real estate investments. We are able to identify great buying opportunities for the following types of buyers:

Below renovations took an average of 3-8 months to complete, with an private lender return of 12%.

| 1100 W. 3rd Street | |

|---|---|

| Purchase Price: | $80,000 |

| Repair Cost: | $17,209 |

| Total Lender Invested: (10 Month Hold Time) | $100,000 | Sales Price: | $130,000 |

| Private Lender Return on Investment = | $25,959 |

| 2 Oak Circle | |

|---|---|

| Purchase Price: | $95,000 |

| Repair Cost: | $21,300 |

| Total Lender Invested: (4 Month Hold Time) | $110,000 |

| Sales Price: | $153,900 |

| Private Lender Return on Investment = | $33,323 |

| 251 Anne Ave. | |

|---|---|

| Purchase Price: | $39,000 |

| Repair Cost: | $36,314 |

| Total Lender Invested: (11 Month Hold Time) | $70,000 |

| Sales Price: | $120,000 |

| Private Lender Return on Investment = | $7,700 |

A private money loan is a loan that is given to a real estate investor, secured by real estate. Private money investors are given a first or second mortgage that secures their legal interest in the property and secures their investment. When we have isolated a home that is well under market value, we give our private lenders an opportunity to fund the purchase and rehab of the home. Through that process, the lender can yield extremely high interest rates – 4 or 7 times the rates you can get on bank CD’s and other traditional investment plans.

Essentially, private money lending is your opportunity to become the bank, reaping the profits just like a bank would. It’s a great way to generate cash flow and produce a predictable income stream - while at the same time, provide excellent security and safety for your principle investment. You can do what the banks have been doing for decades… make a profitable return on investments backed by real estate. There is no other investment vehicle like it.

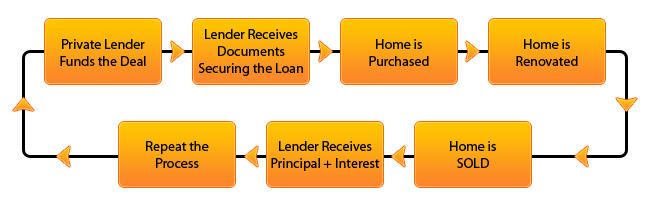

The process is simple. We find an extremely undervalued property we want to purchase - and once you give us the green light, we borrow the funds from you to purchase and renovate the property. At closing, you receive a mortgage on the home along with other important documents. Next stage is the property renovation. Once the renovations are complete (typically 3-6 months depending on the size of the project), we’ll list and sell the property. When it’s time for closing, you’ll receive your principle plus 10% (or agreed) interest payment. It’s just that simple! The goal is to keep turning that money for you and keep you making substantial profits so you keep coming back to us – building a long term mutually beneficial relationship

Typical Hold Time:

You, as the private money lender can benefit greatly from investing your capital. A real estate mortgage/ deed of trust provides you with security instruments you would not get with other investments. You also have added layers of protection because of how we buy, and because you have recourse available to you in case we were to default on the loan.

We currently pay 4-7 times what a typical bank CD is paying. Our rates will fluctuate very little all depending on the purchase price and rehab involved. The lower the price we pay for a home, we can pay a little higher rate to make sure our lenders make it worth their time. Private lending means you can relax while the money is in a truly safe place, working for you.

What’s in it for you?

Our equity is built in the purchase of the home, where we are buying 30-40% below a retail buyer – that creates instant equity at purchase. Also, in a typical transaction, we cut out the middleman cost, such as: commissions, mortgage broker fees, loan fees; and our attorney costs are also lower because there is less work for them to review.

Because of our buying strategy, we are able to offer our buyers a fully renovated home at or below everything else in the neighborhood. We walk away from hundreds of “close” deals that do not meet our specific buying criteria, and simply won’t buy unless it makes sense for everyone involved.

| Sitting in Bank | Real Estate Private Lending |

|---|---|

| $100,000 x 1% interest | $100,000 x 10% interest |

| 12 Month Term = $1,000 ROI | 12 Month Term = $10,000 ROI |

| *Backed by Real Estate Private Lending |

| Stock Market | Real Estate Private Lending |

|---|---|

| Completely Unsecured | Secured by Deed of Trust or Mortgage Deed |

| Completely Uninsured | Collateral is Fully Insured |

| Invest at Market Price | Collateralized Below Market Value |

| Returns Are Unknown | Returns Are Fixed and Agreed Upon Term |

| Tangible Asset |

Private money lenders bring speed and efficiency to our transactions, and our leverage is far greater when we purchase using private cash funds . Many of the homes we are purchasing are in need of quick sale within 10-14 days. A traditional bank requires 30-60 days to close a loan. Many traditional home sales fall out of contract because of financing issues. Using quick cash as leverage allows us to negotiate a much lower purchase price and reduce our risk.

Being able to offer a fast closing with private funds motivates sellers to take our offer over the competition, and entices them to take a much lower price than they would from a conventional buyer. Also, lending guidelines are continually changing and are requiring applications, approvals, junk fees and strict investor guidelines. They also limit the number of investment properties that can be purchased by one company.

On a new home purchase requiring renovations, private lender funds will be allocated to the purchase price, renovations, carrying costs, cost to resell and a small buffer for unexpected expenses.

Mortgages offer the banks solid, long-term, fixed returns. You can put yourself in the position of the bank by directing your investment capital, including retirement funds to well-secured real estate mortgages. Mortgages have ultimate safety because if default occurs, the bank can recover its investment as the first lien holder on the property

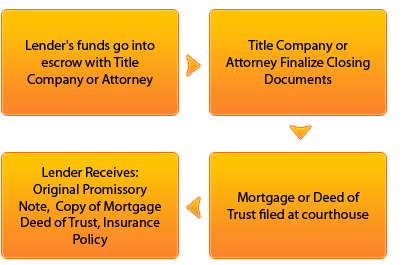

Each property we acquire is put through a rigorous evaluation process in order to assess the profitability before the property is ever purchased. “lntegrity" is an essential part of our business, and we only make sound investment decisions. Also, for your protection, you are also provided these documents to secure your investment capital:

Promissory Note: This is your collateral for your investment capital

Deed of Trust/Mortgage: This is the document that is recorded with the county clerk and recorder to publicly secure your investment against the real property that we are providing as collateral

Hazard Insurance Policy: This is where you as the private lender would be listed as the “Mortgagee” for your protection in case of fire or natural disaster, etc.

We do pay for a title search as well as a title policy on the home just as we would in a typical transaction. For a rental investment with a long-term note, we always keep a valid hazard insurance policy on the property to protect against causalities. You’ll be named as a mortgagee and notified if the insurance was not kept current. In the event of any damage to the property, insurance distributions would be used to rebuild or repair the property, or used to repay you.

Common Sources of Funding

Cash held in most types of bank accounts can be accessed quickly and can fund your deals in minutes, instead of hours or days. Fees are generally minimal for wire transfers and cashier’s checks.

A home equity line of credit is a very powerful source of funding that many people have and don’t even think of. Unleveraged equity is dead money and it’s not making any interest. You can easily tap into that money. It’s a way to make sure you’re in first position when we’re ready to pull the trigger and buy a property.

Personal loans and “signature lines of credit” can be obtained from most banks or credit unions by anyone with good credit and a stable income.

More and more private money lenders are using their IRA funds to invest in real estate. A selfdirected IRA is essentially the same as a traditional IRA, but allows you to purchase a broader range of investments, including real estate.

Investments are a way to put your savings to work earning more money. However, if your stocks and investments have not performed as you had expected, it might be time to consider other investments. As you know, stocks can be liquidated as and when you wish. Sometimes you need to liquidate your investments because you need the money for something you want to purchase such as real estate.

Most people think that an IRA can only be used to purchase investments, like stocks and mutual funds. But that’s not true! You can get private mortgage loans using the funds which are already in your IRA’S and other retirement plans.

As it pertains to lending for real estate investments, enter the Self-Directed IRA. The IRS has set forth guidelines on what you can and cannot invest in with your IRA. Many people are surprised at the scope of options available. From tax liens, gold, real estate investments and real estate notes, IRA’s are much more powerful than most people ever realized. If you add to that power of a Roth IRA which allows you to enjoy your earnings tax-free or deferred, and you’ve got a fast road to an easy retirement!

However, in order for you to use retirement accounts for loans, they must first be administered by a third party custodian. After selecting your custodian, you simply send a transfer form to them and they’ll do all the work for you, once you've done that you are ready to make private mortgage loans. We would be happy to recommend a local custodian we’ve worked with in the past who can assist you with setting up your account.

Retirement Accounts That Can Be Self-Directed

*Profits can be tax free or tax deferred when you invest with one of these vehicles

Minimum Investment:

When working with private lenders, $50,000 is our minimum standard investment. When first investing with us, a lower initial investment amount may be agreed upon to ensure you’re confident when working with our company.

Mortgage Terms:

The majority of our loans are set up on an 8-12 month note; however, it depends on the size of the project. If we are doing a teardown and rebuild, we will have to wait on the county inspectors for many approvals - thus causing delays. We account for all of those details upfront and will give you estimated time frame for the return on your investment. Also, we do not pool funds - your funding will be tied to one piece of property secured by a deed of trust.

Payment Schedule:

Typically, we pay one large lump sum at closing on a short-term note. This is much easier to manage for both of us, especially if we’re working out of a retirement account. On a longer note, we will pay monthly just like a typical mortgage.

1st or 2nd Lien Position:

The Investor, as “mortgagor,” has the right of first lien holder and Power of Sale on the property. The 1st lien position is placed behind a senior mortgage. You are probably used to hearing the term first and second mortgage. The second mortgage is a junior lien because it’s in 2nd position. The senior lien or first mortgage must be paid prior to the 2nd lien.

Investment Terms & Conditions

Since Success Story Real Estate was founded in 2003, we’ve closed over 16 million dollars in real estate transactions. Considering the state of our economy and the challenges of our housing market, this is an achievement that did not come easily.

The reason we share our transaction history is not to impress you, but rather impress upon you the fact that Success Story has the experience and expertise necessary to help anyone find a solution to their real estate needs. Choosing the right company to work with will always be one if the most important steps of that process. So how do you get to over 16 million in closed transactions? One house at a time. Here is a list of a few of our closed transactions since 2003.

OUR TRANSACTION HISTORY |

|||

|---|---|---|---|

| 314 Westchester Dr. | 26 Forrest Green | 5833 Gilchrest Rd. | 5831 Gilchrist Rd. |

| 5831-A Gilchrist Rd. | 316 Fletcher Ave. | 319 S. Thompson St. | 430 S. Parsons Ave |

| 558 W. French | 906 S. Florida Ave. | 908 S. Florida Ave. | 914 S. Florida Ave. |

| 31446 Skyline Dr. | 1266 Essex Rd. | 31242 Lake Dr. | 8 Lenox Ct. |

| 9 Lenox Ct. | 436 Lisbon Pkwy | 44645 Lake Mack Dr. | 7929 Mariner St. |

| 5202 Cemetery Rd. | 31330 Inez De. | 44015 Jessie Dr. | 251 Anne Ave. |

| 8695 Alexa Dr | 8698 Alexa Dr. | 8684 Alexa Dr. | 438 Cahoon Rs |

| 8125 Old Plank Rd. | 8135 Old Plank Rd | 8110 Albany St | 8120 Albany St. |

| 8130 Albany St. | 8150 Albany St. | 7845 Stuart Ave. | 7853 Stuart Ave. |

| 7861 Stuart Ave. | 7867 Stuart Ave. | 1255 S. Lake Shore Way | 308 S. Thompson |

| 200 Old Daytona Rd. | 802 Arizona Rd. | 1100 W. 3rd St. | 8746 Dandy St. |

| 38820 Tall Dr. | |||

| Palms Mobile Home Park | Hontoon Mobile Home Park | Westport Mobile Home Park | Shady Oaks MH Park |

| Malabar Business Complex | LakeSide Villas Motel | Briarwood MobileHom Park | Malabar Motel |

| Trout River MH Park | Arroyo Mobile Home Park | Happy Time Motel | |

Thank you Nader for everything. You have been a blessing to me and my wife. I am looking forward to working along side you and the team and I will do everything I can in order to help things run smooth.

Nader, I never sent you any emails thanking you for all you did to inspire the group and help keep morale up. You did a fantastic job

First, thank you! I came away with a new and even higher respect for you than I already had. Many people can tell others how much they care…others, like you SHOW it.

Nader, it’s an honor to work closely with you and for what it’s worth you have earned my respect and admiration. I look to you as a mentor before I do anything else. The foundation is stronge because of you

I just wanted to let you know that I realized how very lucky and proud I am to have a friend like you. You are quite a wonderful man.

My time in the program with you has been a great benefit for my personal growth and I will continue that thinking and mind set. Thank you for the time you spent with the group and the love and caring that you shared with us

Nader, no one could have done this better. You are a genius at this stuff. I know that it comes easy because you believe it but it’s still impressive.

Nader is a self motivated, creative mind , active , flexible team player and has leading skills, deep understanding of adding value concept

Over the past 20 years I have worked with hundreds of leaders and Nader stands out as the most dynamic, compelling, hardest working and easiest to do business with. I truly appreciate his collaborative spirit and his intense focus on exceeding client expectations. Nothing he does is "one size fits all." He works hard to understand a client's deepest needs, then builds out a solution to directly address those needs - always bringing new ideas and insights to the table.

I have known Nader for over 25 years. He has been the best life long friend I have. He is always available if you need him. He has been like a Brother to me. He is brilliant in Business and a true friend in life.

Nader is an excellent Coach and he has been a great influence for me. His attitude has impacted my life in a way Nader cannot imagine. He is always willing to help, he always finds a positive way to see life, it is a pleasure to be part of the same Group.

Nader is a Get-It-Done type of person who is exceptional at showing others how to really GetIt-Done and achieve tremendous results for themselves. He has always made me feel empowered and confident, Life without Nader, ...I' can't imagine it.

Nader continues to exceed my expectations in the way he treats his colleagues. He is always willing to go beyond the norm and that is because he places such a high value on his personal relationships. He has such a kind and gentle way about him that you immediately feel at ease in his company. I continue to learn from him every week and it is a pleasure to call him my friend.

Here are just a few of our past rehab projects:

Here are just a few of our past rehab projects:

If we haven’t already, it’s important to sit down and discuss all these details in person. We will need a clear definition of what your goals are, i.e. long term investment or short term, and the amount you are comfortable initially investing. At that point, we will present you with any current opportunities that fit that criteria or contact you as soon as we have one that fits.

If you have any interest in this opportunity, please send us an email: Nader@Ashchi.com

Word of mouth is typically how we are able to work with private lenders like you. It would be greatly appreciated if you passed our information on to anyone that may be interested in the opportunity to be a lender. In our business, it’s always important that we have a steady stream of lenders. Once you’ve done a few deals with us and you’ve learned how we’re purchasing so low, you may attempt to do it on your own. If that’s your goal, we’re happy to help you any way we can.

WHAT IS PRIVATE LENDING?

When we have isolated a home priced well under market value, we give our private lenders an opportunity to fund the purchase and rehab of the home. Lenders can also earn high interest rates - generally 4 or 5 times the rates you can get on bank CDs and other Traditional Investment Plans.

HOW IS THE MONEY USED?

On a new home purchase requiring renovations. The cost will be allocated to the purchase price, renovations, carrying costs, cost to resell, and also a small buffer for unexpected expenses.

WHY DON’T YOU GET A TRADITIONAL LOAN?

There are many reasons, but the primary reason is: time and negotiation leverage. Many of the homes we are purchasing are in need of a quick sale within 10-14 days. A traditional bank requires 30-45 days to close a loan. Also, our leverage is far greater when we purchase using cash instead of financing. Many traditional home sales fall out of contract because of financing issues; and this allows us to negotiate a much lower purchase price and reduce our risk.

Lending guidelines are also continually changing. Most new requirements include applications, approvals, junk fees, and strict investor guidelines. They also limit the number of investment properties that can be purchased by one company.

HOW CAN YOU AFFORD TO PAY SUCH HIGH RETURNS?

We make our money on the purchase, and this allows us to purchase 20-30% below a retail purchaser. This instantly creates thousands of dollars in equity. Typically, we also cut out the middleman in a transaction, i.e., commissions, mortgage broker fees, loan fees. Our attorney costs are usually also lower, because there is less paperwork to review.

ARE YOU REALLY HELPING SELLERS?

Absolutely. With your cash funding, we can offer something very few buyers can. We are buying within their timeline in as little as 10-14 days. Knowing that we’re going to renovate the home and purchase it in as-is condition is a very important factor to most sellers of distressed property. The seller also won’t have to pay any additional fees.

WHAT IF THE MARKET GETS WORSE AND VALUES GO DOWN?

This is a great question and valid concern. However, our strategy is not to speculate 3 years down the road. Our goal is to purchase quickly and sell even faster. Most of our projects are complete in 1-2 months and will be sold in 4-6 months. The market doesn’t tend to shift that dramatically in a matter of months - it’s typically a longer process for an area to decline. Remember, we’re buying in strategic areas where inventory is already low and demand is high; this greater minimizes our risk.

WHAT INTEREST RATE DO YOU TYPICALLY PAY YOUR PRIVATE LENDERS?

Most of our lenders are paid from 8% - 12%. Our rates will fluctuate very little all depending on the purchase price and rehab involved. The lower the purchase price, we can sometimes afford to pay a little higher rate to make sure our lenders make it worth their time.

HOW LONG WILL MY FUNDS BE HELD?

The majority of our loans are set up on an 8-12 month note, but it depends on the size of the project. If we are doing a teardown and rebuild, we will have to wait on the county inspectors for approvals. This will cause delays. But we account for all of those details upfront and will give you estimated time frame for the return on your investment beforehand.

WHAT IF I’M ON A SHORT-TERM NOTE AND SELL THE HOME AFTER ONLY 1 MONTH?

It’s extremely important to us that we do not waste your time. However, occasionally, situations may occur where we find a buyer immediately. In this scenario, we provide you with two options: we can either move the note to another property, or provide you with a minimum of 3 months interest. Most investors see the strength of our purchase ability at that point, and simply move the note to another property.

WHEN WILL I RECEIVE PAYMENTS?

Typically, we pay one large lump sum at closing on a short-term note. This is much easier to manage for both of us, especially if we’re working out of a retirement account. On a longer note, we will pay interest monthly, just like a typical mortgage.

IS THERE A GUARANTEE ON YOUR INVESTMENT?

No. There is no government backed guarantee on these privately held real estate notes. You’re deriving protection from the equity in the real estate. If at any time we were to default on the note, you have legal right to take the home (essentially foreclose on us). Some investors laugh about this one and say, “I hope you’re a day behind on payments - I’d gladly take this one off your hands.” You have to remember that we plan for the worst, and our homes have thousands of dollars of equity in them. So in a worse case scenario, often times we just don’t make “as much” profit as we originally hoped for.

IS THE IRS APPROVED TO USE RETIREMENT ACCOUNTS IN THIS MANNER?

Yes, these are established tax guidelines, and it is completely legal. However, we always recommend the services of a custodian to invest retirement funds tax deferred or tax-free.

WHO BUYS INSURANCE?

We do. We pay for a title search and also a title policy on the home, just as we would in a typical transaction.

WHAT KIND OF INSURANCE POLICY DO YOU GET ON THE HOME?

If we purchase a renovation, we get a builders risk policy (Vacant Dwelling Policy). In case of any damage, insurance distributions would be used to rebuild or repair the property, or used to pay you off.

HOW MUCH IS IT GOING TO COST ME TO LEND TO YOU?

It is our policy to pay for all the closing costs so that your entire investment goes to work for you. We will pay for the closing agent, document preparation fees, notary fees, overnight mail fees, bank wire fees and recording costs. We do not charge any fees or commissions to you.

WILL MY MONEY BE POOLED WITH OTHER INVESTORS?

No, we do not pool funds. Your funding will be tied to one piece of property secured by a deed of trust.

IF YOU DEFAULT ON THE LOAN, HOW DO I ACQUIRE THE PROPERTY?

In this unlikely scenario, we would simply transfer ownership of the property to you, if possible. If for any reason we did not (or could not), then you have all the legal rights of a secured lender. The best way to legally protect your interest in case of a default would be to hire an attorney. They normally would seek to retrieve your investment, any unpaid interest, any collection costs, all your attorney fees and maybe even more. An attorney could advise you of whether or not it makes sense to foreclose on the property or seek ownership to protect or recoup your investment.